Because China skipped the credit card payment model and went straight from cash to mobile payments, much of the money that would have traditionally gone to banks in the form of fees and processing charges have remained in the hands of consumers and merchants.

If you missed it, check out part one of China's unique eCommerce and mobile payment ecosystem.

Mobile payments fee structure

Because the legal requirements for accepting mobile payments are also different, the eligibility can exclude certain vendors. This also impacts fees and regulations. Additionally, one of the most restrictive limitations foreign companies run into when trying to reach Chinese markets online is setting up a mobile payment system.

Per Chinese law, only China-based companies can set up payment methods with Alipay or WeChat Pay. So it would take some effort to navigate through this process. Often the best way to navigate this landscape is to partner with a third-party technology expert who can provide solid, up-to-date advice on how to implant a mobile payment platform effectively.

Related reading: All you need to know about WeChat mini-programs

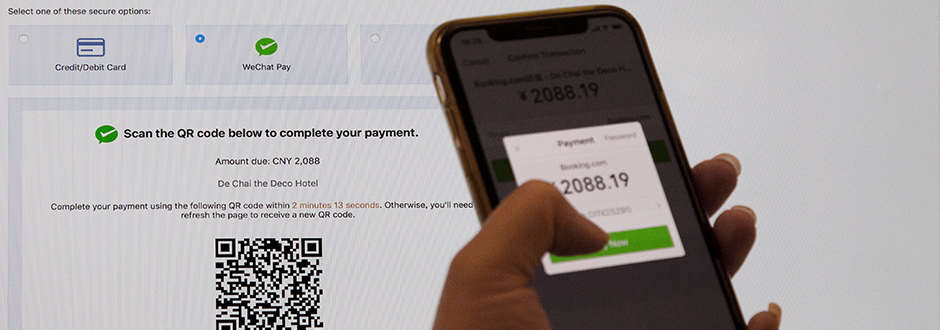

The traditional models for credit card payment prevalent throughout Europe and North America have been challenging to implement for Chinese websites. Most users prefer paying via methods they're comfortable with, like WeChat Pay or Alipay. Mobile vendors in China have been reluctant to adopt accepting credit cards because consumer preference is clearly in favor of app-based payment methods.

This has made conducting business effectively tricky for international companies looking to break into the Chinese market without understanding mobile payments' preferences. While some businesses offer alternative mobile payment methods in China, these are the primary methods, while traditional credit cards are virtually non-existent.

How do foreign businesses accept mobile payments in China?

What does this mean for businesses looking to start accepting mobile payments? The first step for any business looking to achieve success with online retail in China is to have your payment processing systems in place from day one. With practical network analysis and robust digital architecture, you can start accepting mobile payments or direct bank transfers immediately.

Clearly, the payment landscape in China differs from the rest of the world, and these unique hurdles make it imperative to have a partner that thoroughly understands the legal requirements for anyone conducting business in mainland China, Hong Kong, and Taiwan. However, that's not to say there aren't advantages to China's mobile payment revolution.

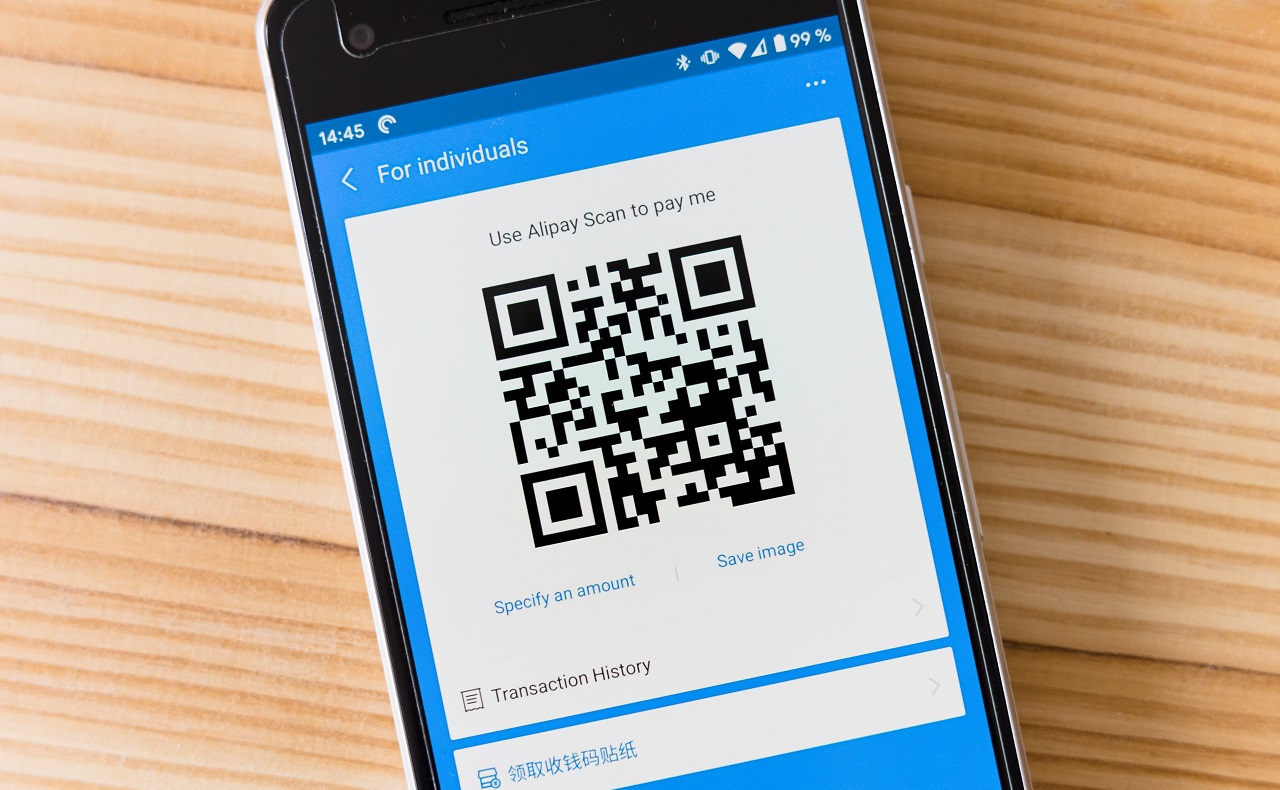

Because apps and smartphones have become so popular with consumers, everyday purchases being conducted on platforms like Alipay and WeChat Pay allow businesses to convert more sales and increase revenue without incurring hefty processing fees found in the traditional credit card model. Also, as consumers trust app-based spending, other expenses are reduced as buyers can simply scan a QR code, and the transaction is complete. With transactions occurring in real-time, business owners have access to their funds which aren't being held by processing firms. This allows both consumers and merchants to exercise more control over their finances.

Related reading: Consumer trends: 5 unique habits of online shoppers in China

This payment system is continuously evolving as China's government imposes or lifts new restrictions. Companies like Alipay work with international companies to negotiate with the government to improve financial conditions. Businesses looking to expand into China need to have a thorough roadmap for establishing their mobile payment systems in place to avoid missing out on potential revenue and also to avoid any legal ramifications.

Related Reading: Why you need to optimize for native mobile web browsers in China

As these restrictions evolve, our team at GoClick China continues to explore the best methods and strategies to develop and implement the best practices for conducting business online. GCC is your one-stop solution for helping you establish a secure mobile payment system. We can advise you on how to navigate the application process, develop the necessary elements of your backend system and help you monitor and analyze the network for security and reliability of the payment process.

To learn more about succeeding in China, check out our other articles.

If you want to learn more about testing in China, check out our solutions.