China developed a unique e-commerce and payment ecosystem that differs from other major economic markets because of the early adoption of mobile payments rather than debit or credit cards.

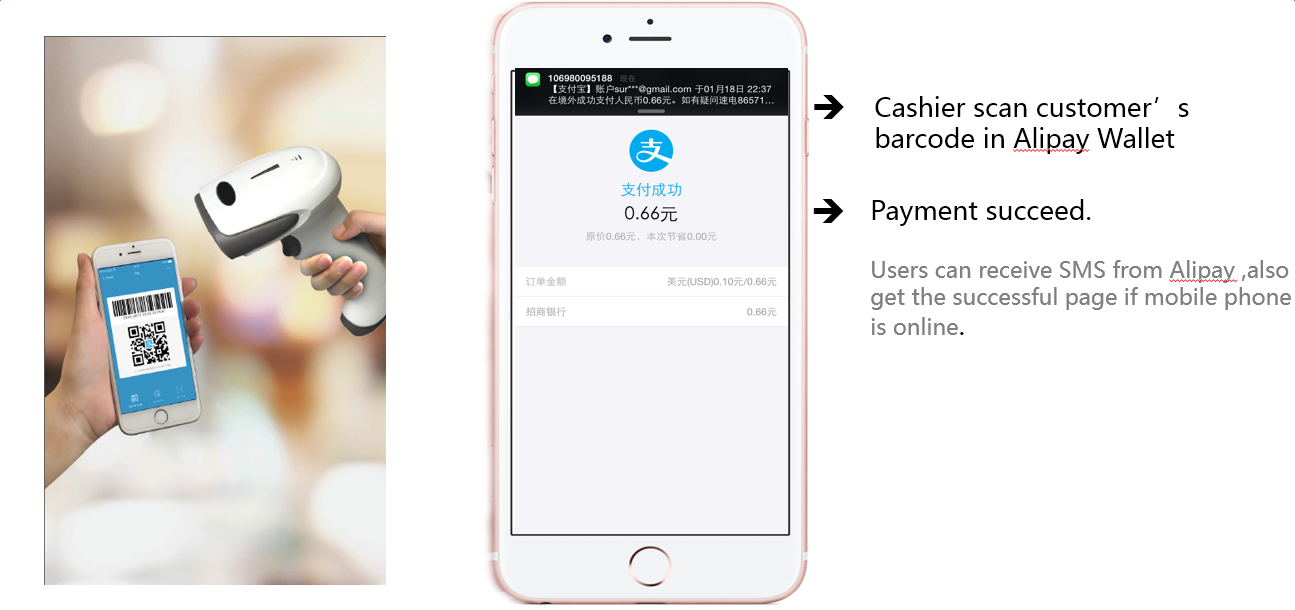

Both urban and rural consumers have adopted mobile payment methods, which have gained even more traction with the COVID-19 pandemic. Touchless options like QR code scanning have allowed consumers to make payments without coming into physical contact with vendors.

China skipped a generation of digital payments and went directly to mobile-based payment apps, which allow for easy transactions and rapid movement of funds between accounts. Merchants preferred these payment methods because they removed the fees associated with credit or debit card processing which average around 2% of the total amount.

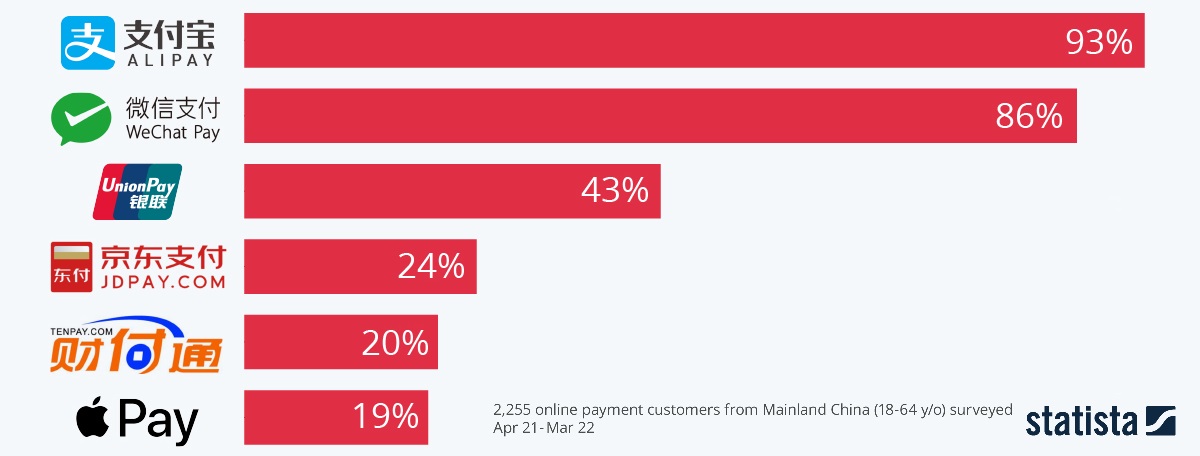

The popularity of mobile app payments has created a need for dynamic payment processing solutions for both online and in-person retailers. The most popular payment processing solutions in China are Alipay and WeChat Pay.

Consumers prefer these methods because their app-based solutions are more user-friendly, affordable, and secure, and they don't have to take time to apply for a credit card. It's also easier than going through a state-owned bank. Paying with a mobile phone has become the norm across China, and cash payments have become virtually non-existent, quickly transforming the country into a cashless society.

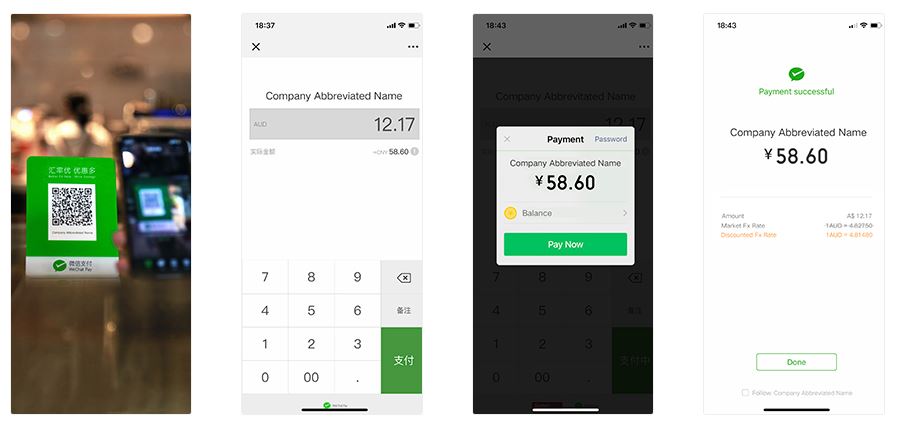

Also, the ease of completing a transaction by scanning a QR code or using an NFC scanner with a mobile device has made it so that encrypted data allows users and merchants to safely process payments without opening themselves up to fraud or security breaches.

The use of QR codes to quickly provide consumers with information has also allowed Chinese payment processors to adapt to emerging trends. Because of the instability of many websites in the early 2000s, many Chinese consumers weren't comfortable submitting payments online, and solutions like Alipay and WeChat Pay offered secure platforms for merchants and consumers alike.

Another benefit of using QR codes for payment is that these transactions are conducted offline, so merchants don't need to be connected to the internet, just the user whose banking institution will handle the backend of the transaction.

While major international credit card networks like Visa, Mastercard, and Discover explore ways to enter the Chinese payment processing market, other alternatives like PayPal have just entered the sphere. But one of the most significant downsides for Chinese consumers is that using a card issued by one of the major international credit card companies comes with hefty fees and often includes a currency exchange fee. So mobile payments offer an efficient and affordable solution, which has further decreased the already dwindling popularity of credit cards in China.

China's most popular mobile payment processors

Because Alipay works with Visa, Mastercard, American Express, and more than 180 other international financial institutions, it remains the most popular payment gateway for all of China. Alipay entered the payment processing market early and established itself as the trusted way to buy and sell online and in person, while also offering unparalleled ease for both merchants and consumers.

The second most popular payment processor, WeChat Pay, has gained traction due to its integration with the popular social platform of the same name. This synergy has given users the ability to easily buy, sell, and transfer funds from an app that they are already familiar with and trust. With over 1 billion users, it's easy to see why WeChat Pay has become as popular as it has.

Mobile payment is unique because it has a different cost structure and allows for real-time payment processing. This creates the opportunity for faster deposits and withdrawals. Chinese consumers can even pay their utility bills with a mobile device through various apps.

Because Alipay keeps its fees modest, it remains the most popular payment gateway. The fees are generally around .1% for withdrawals over RMB 20,000 (about USD 3000), and merchants are only charged a .55% fee. Alipay does this to keep its cash reserves high. This also partly explains the difficulty credit card has experienced in advancing their adoption in the country.

As more retail migrates online and away from brick and mortar establishments, it's imperative for e-commerce retailers to offer convenient payment solutions for their consumers. In addition, Alipay and WeChat Pay act as escrow account that protects both consumers and merchants from fraud or other security breaches.

Another benefit that Alipay offers is its support for 18 foreign currencies, which allows users to avoid high exchange fees. GoClick China's expertise with front and backend web services allows us to ensure that our clients have the data analytics they need to take their business to the next level.

Our analysis of network connectivity allows our clients to test payment solutions across all platforms which are unique to China. Because the central bank of China restricts cash flow out of the country, Alipay has been working to negotiate terms to change those regulations and free up restricted capital.

The process for accepting mobile payments online is somewhat different from payment methods that utilize major credit card networks. The end result is a significant reduction of transaction costs, which largely benefits the rapid adoption of a new technology-based payment system.

Another major factor that drove the transition from cash to mobile payment was the lack of a valuable-enough large bill in circulation, which made larger purchases more cumbersome and burdened merchants and consumers alike. These new alternatives like Alipay and WeChat Pay have offered secure methods for transactions from small everyday purchases to significant expenditures such as mortgage and car lease payments.

To learn more about succeeding in China, check out our other articles.

If you want to learn more about testing in China, check out our solutions.